HI DoT G-49 2023-2026 free printable template

Show details

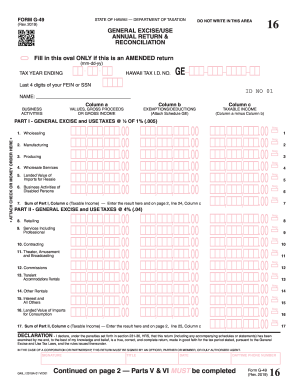

SIGNATURE G49I 2017A 01 TITLE DATE DAYTIME PHONE NUMBER Continued on page 2 Parts V VI MUST be completed Form G-49 Page 2 of 2 Name Hawaii Tax I. 36. 35. PLEASE ENTER THE AMOUNT OF YOUR PAYMENT. Attach a check or money order payable to HAWAII STATE TAX COLLECTOR in U.S. dollars to Form G-49. FORM G-49 STATE OF HAWAII DEPARTMENT OF TAXATION DO NOT WRITE IN THIS AREA Rev. 2017 GENERAL EXCISE/USE ANNUAL RETURN RECONCILIATION Fill in this oval ONLY if this is an AMENDED return mm/dd/yy / / TAX...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign g 49 hawaii form

Edit your g 49 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your g 49 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hawaii g 49 general reconciliation online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT G-49 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out hawaii g 49 tax form

How to fill out HI DoT G-49

01

Obtain a copy of the HI DoT G-49 form from the appropriate website or office.

02

Fill in the 'Applicant Information' section with your full name, address, and contact details.

03

Provide details of the transportation services you offer in the 'Service Information' section.

04

Include your business registration number, if applicable.

05

Complete the 'Affidavit' section, affirming that all information provided is accurate.

06

Sign and date the form at the designated section.

07

Submit the completed form to the appropriate state department via mail or in person.

Who needs HI DoT G-49?

01

Individuals or businesses involved in transportation services in Hawaii.

02

Drivers applying for permits or licenses related to transportation.

03

Companies seeking to register for operating authority with the Hawaii Department of Transportation.

Fill

form g 49

: Try Risk Free

People Also Ask about g 49 tax return

Where can I get Hawaii state tax forms?

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators (FTA) Secure Exchange System (SES) website. The SES website is a secure way to provide files to those that reproduce our forms.

What is G-45 Hawaii tax?

The periodic returns (Form G-45) are used to report gross income, exemptions, and taxes due on business activities periodically. They must be filed throughout the year at specified intervals. The frequency you file depends on the amount of GET your business has to pay during the year.

What is G-49 tax form Hawaii?

Form G-49 - All filers must file an annual return and reconciliation (Form G-49) after the close of the taxable year. Form G-49 is a summary of your activity for the entire year. This return must be filed in addition to Form G-45.

What is the difference between G-45 and G-49 in Hawaii?

What is the difference between the G-45 and the G-49 Forms? The G-45 is the 'periodic' form which is filed either monthly, quarterly, or semiannually. The G-49 is the annual or so called "reconciliation" form which is filed annually.

How do I get my Hawaii state tax form?

To request a form by mail or fax, you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my hawaii general excise tax form g 49 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your g49 form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit hawaii tax form g 49 fillable on an iOS device?

Create, edit, and share g49 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Can I edit form g 49 hawaii on an Android device?

You can make any changes to PDF files, like hawaii g 49 general excise, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is HI DoT G-49?

HI DoT G-49 is a form used to report certain transportation-related information to the Hawaii Department of Transportation.

Who is required to file HI DoT G-49?

Individuals or businesses engaged in transportation activities that meet specified thresholds are required to file HI DoT G-49.

How to fill out HI DoT G-49?

To fill out HI DoT G-49, applicants should provide detailed information about their transportation activities and follow the instructions provided by the Hawaii Department of Transportation.

What is the purpose of HI DoT G-49?

The purpose of HI DoT G-49 is to collect data on transportation activities to inform planning, budgeting, and regulatory oversight in Hawaii.

What information must be reported on HI DoT G-49?

The form requires reporting on vehicle types, miles traveled, types of cargo transported, and any other relevant transportation data.

Fill out your HI DoT G-49 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

g49 Hawaii is not the form you're looking for?Search for another form here.

Keywords relevant to hawaii g 49 use printable

Related to hawaii g49 use printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.